Our Solution

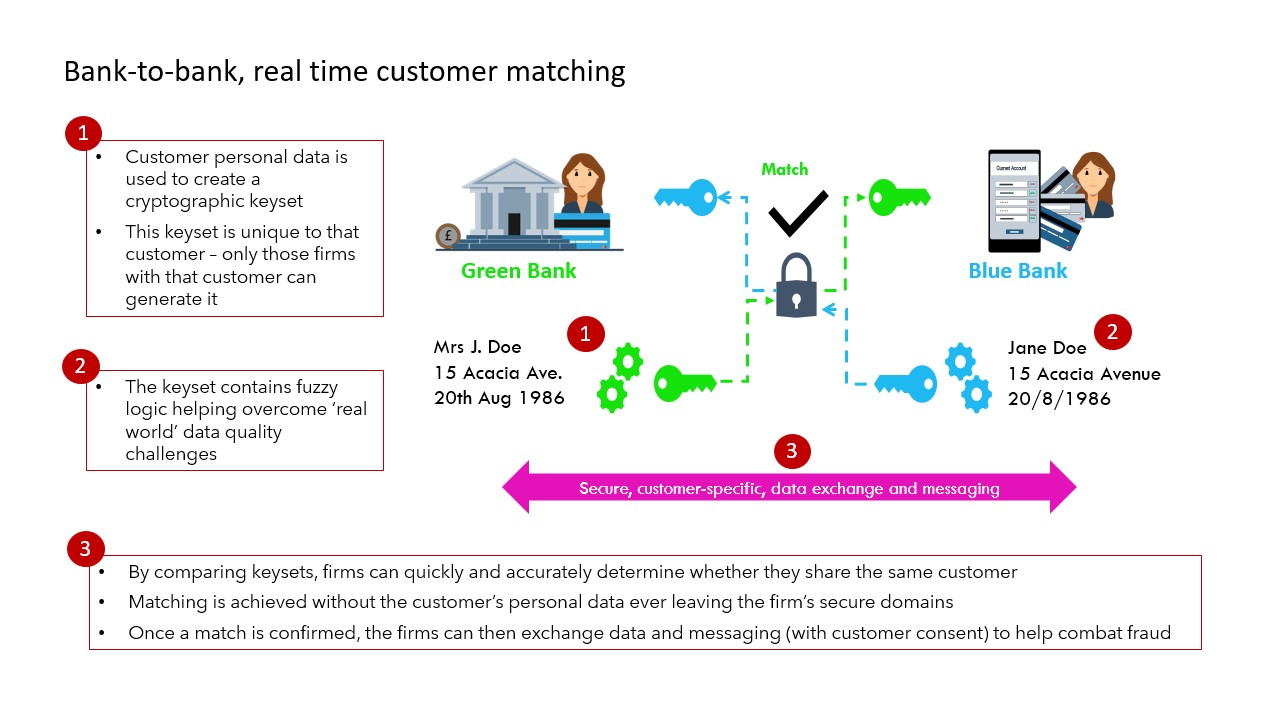

By using a customer's own personal details to create an array of cryptographic hashes, we generate a keyset which is completely unique to that customer.

This provides an unparalleled level of protection for sensitive customer personal data, as it allows firms to match customers directly between themselves without ever having to share or reveal sensitive personal data outside their own secure networks.

Our innovative approach also means firms don’t have to rely on an intermediary to share data and match customers, effectively mitigating data protection risks and safeguarding customer privacy like never before.

Our patented zero knowledge proof (ZKP) matching algorithms can securely and accurately match customer data across firms using only cryptographic hashes as input. These algorithms also have a fuzzy logic component, allowing us to overcome common challenges such as linguistic variations in names, outdated contact details, and inconsistently populated fields.

All decisions regarding customer matches are fully traceable, supporting auditability and Subject Access requests under data protection legislation.

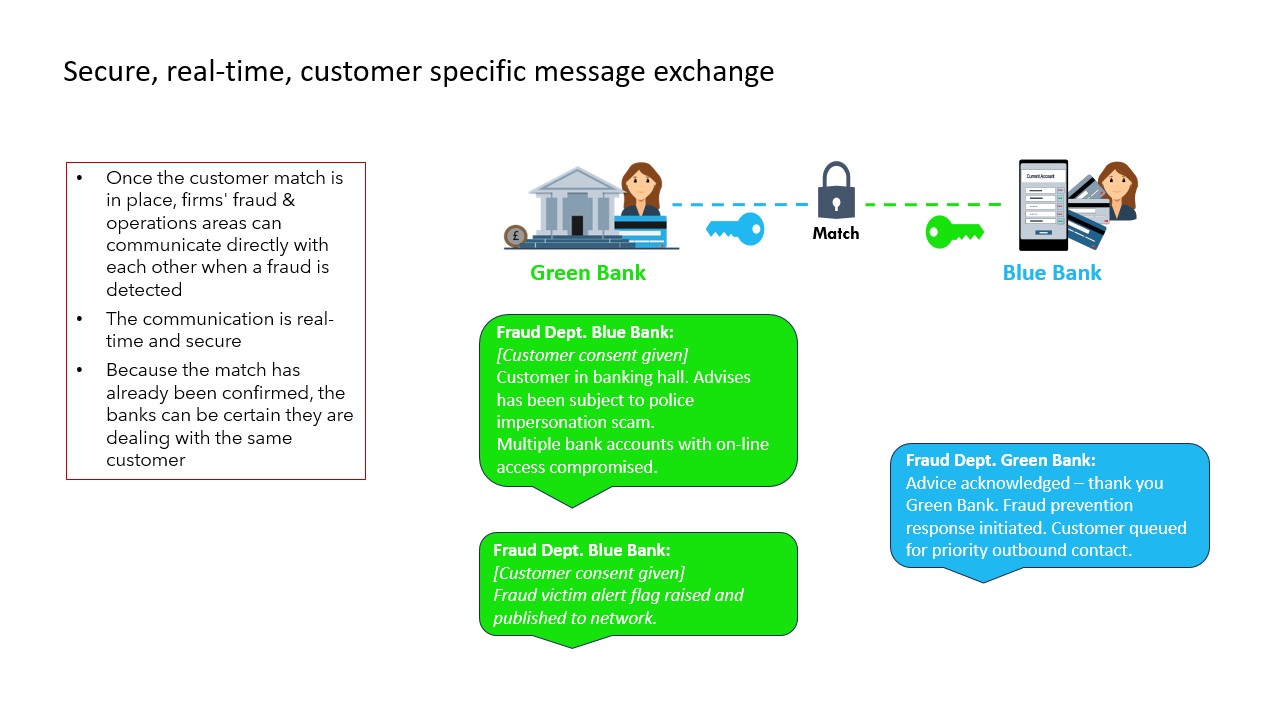

Our platform offers a secure network, enabling financial institutions to seamlessly exchange information via advanced cloud-based services and distributed event streaming technology.

The secure data exchange is fully flexible and configurable. This means it is easily adapted to allow firms to share whatever data is needed to help and protect their customers.

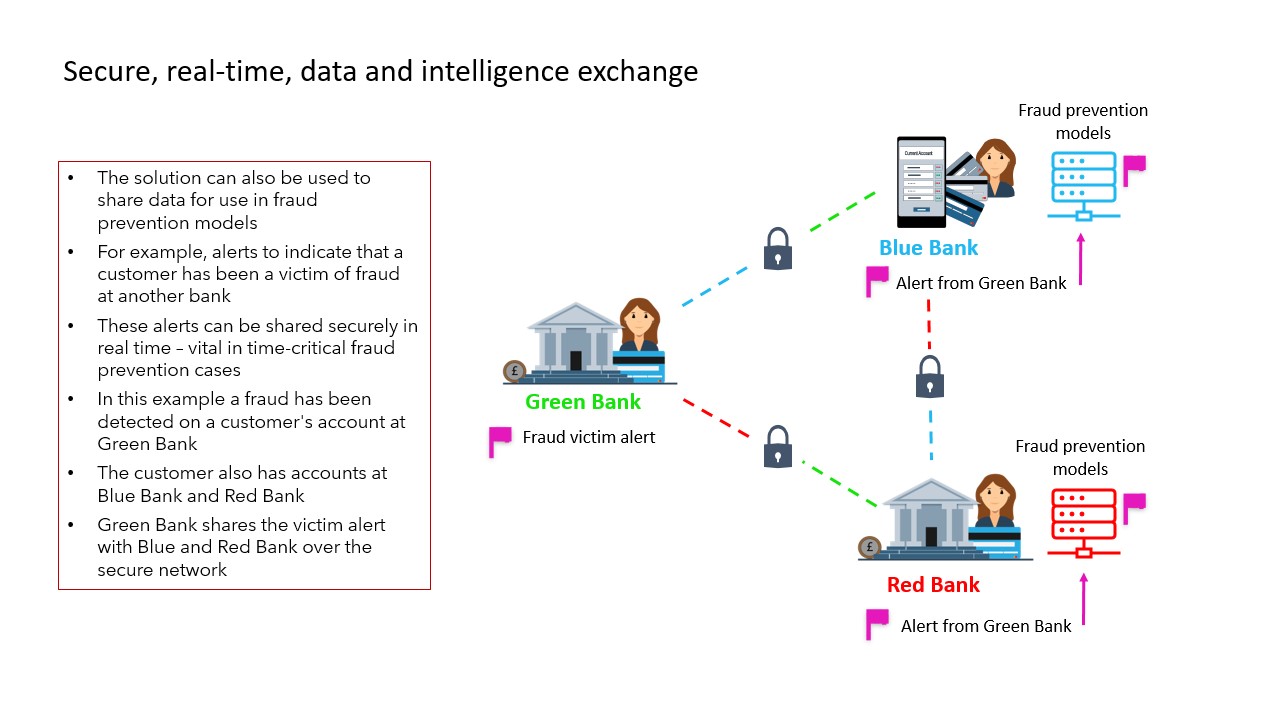

In the example below when Green Bank becomes aware that their customer has been a victim of fraud, they are able to share an alert with other firms on the network (Blue Bank and Red Bank) which share the same customer. In turn, these other firms can use this alert as an input to their own fraud prevention models and systems.

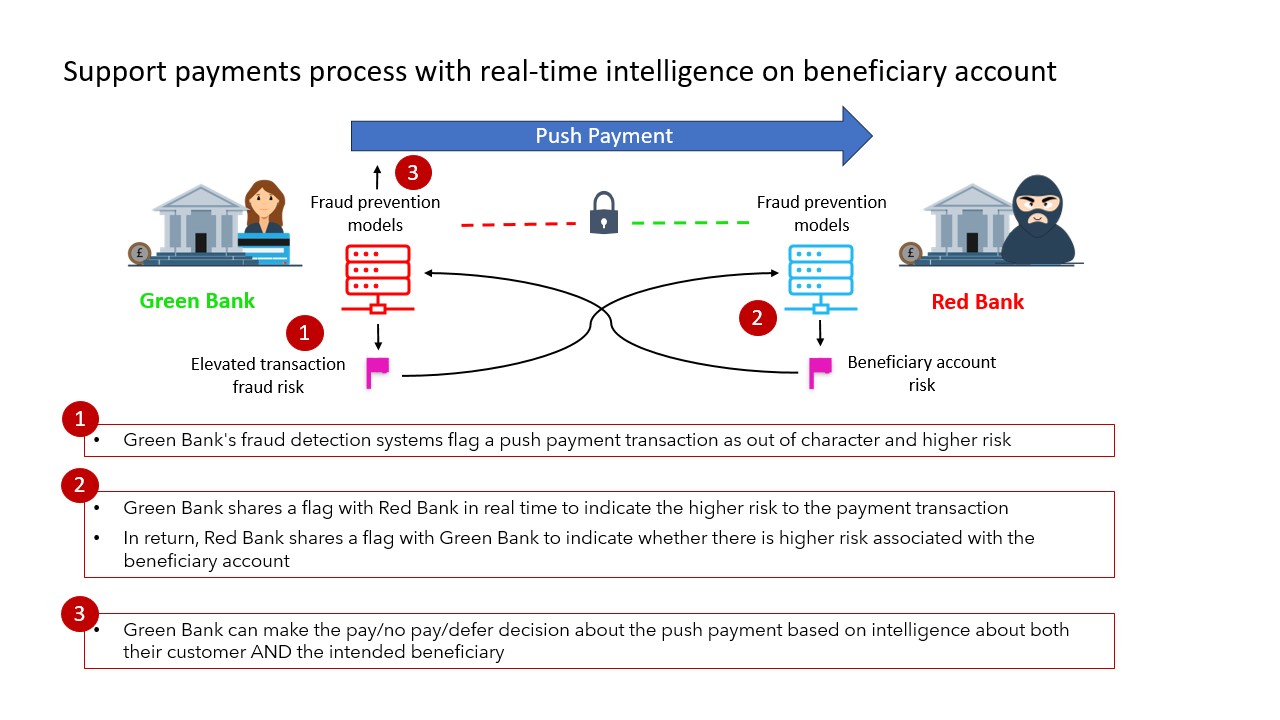

Our solution is also fast enough to support greatly enhanced fraud intelligence gathering in the pay/no pay/defer decision for push payments:

In the example above one of Green Bank's customers is attempting to make a push payment to an account at Red Bank. This transaction is out of character for their customer, and Green Bank's fraud detection systems flag it as higher risk.

The way things currently stand, the only information Green Bank would receive about the intended beneficiary would be 'Confirmation of Payee' (COP).

By using our solution, Green Bank can share a flag with Red Bank, alerting them to the higher fraud risk. In return Red Bank can share back with Green Bank a flag indicating whether the beneficiary account is also considered higher risk from a fraud perspective.

Green bank can then make a decision about the payment armed with intelligence about both their own customer and the intended beneficiary.